Accessible, personal, digital-first: The trends reshaping wealth management in 2024 and beyond

5 minute read

Picture your typical wealth management client.

What do they look like?

In the past, if you'd asked us to make an educated guess, we'd have said they're older, conservative, and most likely a man. Somebody who always wears suits, prefers meeting his financial advisors face-to-face, and wants to preserve and enhance his family's wealth.

But, if that description would've been fairly accurate a decade ago, it's probably as far from the mark as you can possibly get in 2024.

The proliferation of digital technologies has lowered the barriers to entry, making wealth management services more accessible to more people, to the point where the very definition of wealth management has broadened.

More significantly, as customer demographics are changing, so are their priorities and expectations. Which means legacy wealth management firms need to rethink their approach, or risk falling behind.

So what are the trends driving these changes? And how do wealth managers need to adapt in response?

Wealth management for everyone

The biggest change that digitalization has brought about is that it has made wealth management accessible to everyone on their smartphones.

Platforms like RobinHood, Admirals, or Coinbase, have simpler eligibility requirements than traditional wealth management firms, including much lower minimum investment amounts — you can start with as little as $10. And this means large swathes of people for whom investing used to be out of reach can now open online accounts and start buying stocks and ETFs.

These apps — and retail investment more generally — exploded during the Covid pandemic, mainly because people had more free time during lockdowns and took the opportunity to educate themselves about stock trading.

Paderborn University found that, every time Covid-19 cases doubled in 2020, prompting people to stay at home, the number of retail investors increased by around 13.9 %.

Four years later, these investors are a force to be reckoned with on stock markets around the world.

In the first quarter of 2024, the number of European retail investors trading ETFs rose 36 % over 2023, with first-timers more than doubling. The US stock markets are attracting similarly record-breaking numbers, with retail inflows in 2023 up 84 % over 2019.

Most of these investors are younger, and expect service providers to have enhanced digital capabilities.

Crucially, they have mortgages — or, increasingly, high rents to pay — student debt, and average salaries. They can't afford three or four-figure minimum investments, or pay steep fees. So, unless legacy wealth management firms tailor their products and approach, they'll lose ground to digital-first competitors.

The great wealth transfer

Given that, by 2028, there will be 28 % more high-net-worth individuals globally than there are today, missing out on the mass market might not seem like such a big deal.

Until you realize that the demographics of the high-net-worth market are also changing. Over the next 20 years, $84 trillion in assets will switch hands. And the bulk of it — $72 trillion — will go to Millennials and Gen Zers.

Contrary to the stereotype, younger consumers value the human touch. Research from Refinitiv found they overwhelmingly consider advisor recommendations to be the most trustworthy source of information.

That said — and regardless of their income bracket and how much money they have in the bank — younger investors are also very much digital-first. 71 % think having a good website is critical and 40 % expect wealth managers to be active on social media.

Younger investors are also more purpose-driven, with some studies even suggesting they're willing to accept lower returns if it means investing in stocks that align with their values.

Most significantly, the gender split is changing. Women already make up 40 % of consumers in this traditionally male-dominated space. And, over the coming decades, they'll overtake them.

Women's attitudes, priorities, and expectations when it comes to investing differ markedly from those of men. They prefer financial security over growth, and need products that are flexible enough to adapt to their practical realities, such as the gender pay gap and the fact they often take on the bulk of care-giving responsibilities.

As things stand, most wealth managers are not only falling well short of these requirements, but unconscious biases also make the process of seeking wealth management services uncomfortable and off-putting.

The "Amazonification" of wealth management

Digitalization has raised the bar for customer service across the board, and wealth management is no exception.

An IPSOS report released in 2017 observed that exposure to digital technology has led to:

"[consumers' expectations being influenced] by a much wider body of prior experiences than before, beyond directly comparable sectors…. the service provided by One-Click Ordering or Apple's Genius Bar affects the way consumers expect to deal with their bank…"

Seven years on, this phenomenon, which the report calls "liquid expectations" is, if anything, even more pronounced.

74 % of Millennials and Gen Z customers expect wealth managers' digital portals to be of the same level as those of tech giants like Amazon, Apple, and Google.

As online courses, forums, and other educational resources become ever more accessible, investors are also becoming more well-informed, and they aren't afraid to take the lead when it comes to decision-making. 60 % want access to better tools so they can manage their investments themselves.

What's more, spending behavior is increasingly being controlled via apps. And with more personal spending data, it's easier for young investors to make decisions about how much money they can invest each month in building their wealth.

Most significantly, for over 50 % of young investors, digital capabilities are a deciding factor when choosing a wealth manager. In an age of heightened competition and soaring customer acquisition costs, this should hammer home just how critical it is to get the user experience right.

And it's not just about removing friction and making it as easy as possible for these consumers to interact with you in the way they're most accustomed to. It's also about delivering a highly personalized service.

In a Refinitiv study, 51 % of 35 to 54 year-olds said they'd be prepared to pay more for products that were tailored to their specific requirements.

Future-proofing your wealth management business, with embedded finance technology

The 5 key user experience requirements for digital wealth management and investing:

- Lower the barriers to entry.

- Give users access to a wider range of investments.

- Tailor your products to exact and very specific requirements.

- Give users access to knowledgeable human advisors people can trust.

- Make the digital experience smooth and seamless so your customers can easily manage their investments.

To meet the needs and expectations of the modern customer and not lose out to more agile, digital-first competitors, legacy wealth management firms have to deal with a laundry list of seemingly completely contradictory requirements.

But while this might seem like an impossible ask, embedded finance technology, which makes it possible to integrate financial products into non-financial user journeys, can provide a way forward.

Embedded finance is beneficial to wealth management firms in two key ways:

- It deepens the relationship with the customer, increasing trust.

- It provides wealth managers with a huge amount of data they can use to tailor their products to their customers in ways that even anticipate their needs.

Consider cards.

Typically, wealth management firms interact with their customers in a limited number of situations: when discussing or reviewing their investment strategy, getting performance updates, or dealing with queries or concerns.

But, if a wealth manager issues branded debit or credit cards, these situations will multiply. The customer will suddenly interact with the brand in everyday situations too: at the supermarket, while shopping online, or even during a night out.

Our latest research found consumers use cards issued by wealth managers as their main — or "top of wallet" — cards. This increases the number of touchpoints by orders of magnitude: the brand is front of mind whenever the consumer makes a payment. And, the more a customer interacts with a brand, the more embedded it becomes into their every day, and the more they trust it.

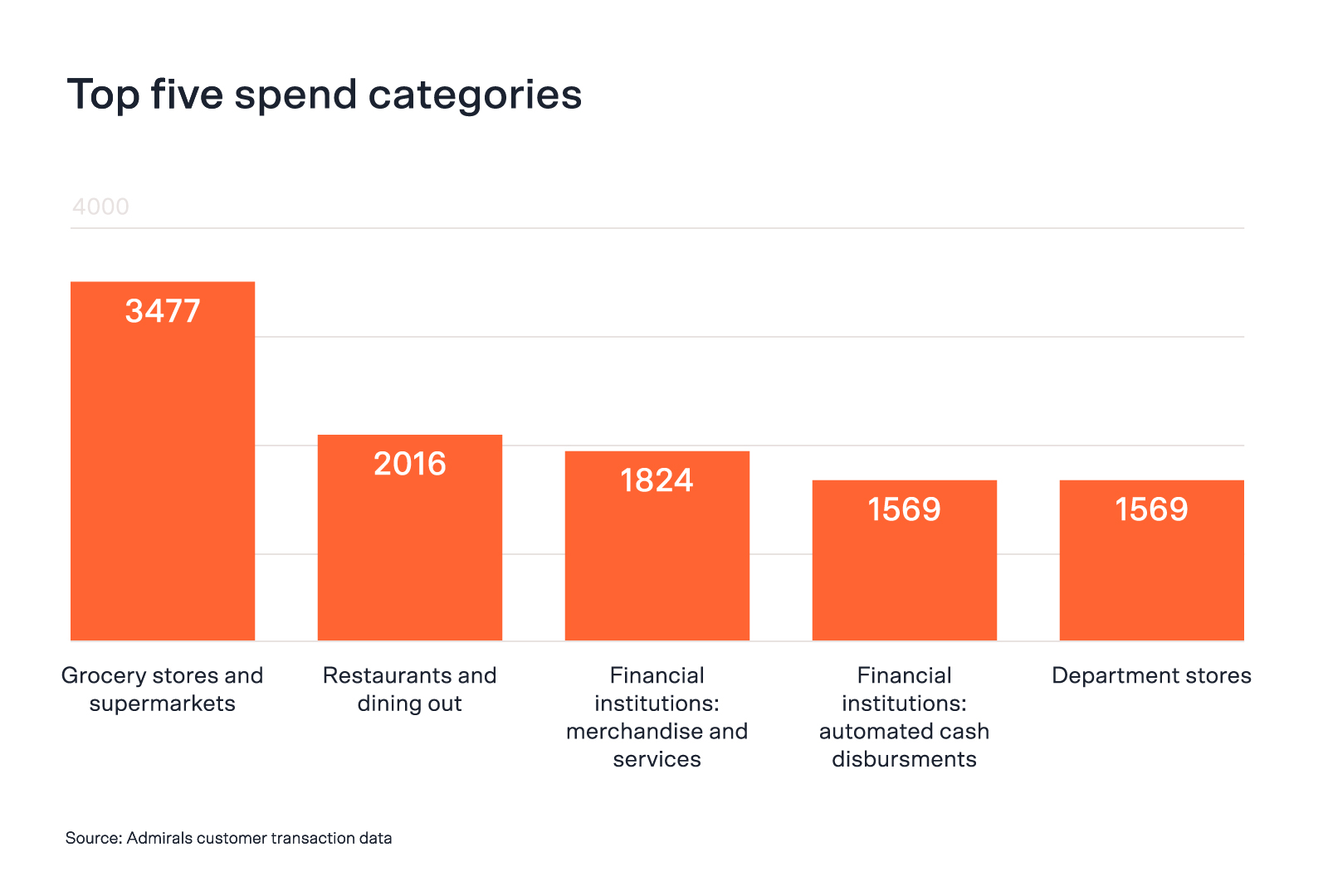

More to the point, the data from embedded finance products such as cards, accounts, and open banking give firms greater visibility into customers' spending patterns and behaviors, making it possible to address their financial health and well-being more comprehensively.

And, the better-served customers feel, the more likely they are to stick around long-term.