Case Study

SpenditEmployee benefits made seamless by Spendit

Spendit is a leading employee benefits provider in Germany and Austria. They offer digital, flexible, tax-free and tax-optimized solutions — including a benefit in kind (BIK), a meal allowance, wellbeing and mobility perks. Employers can easily manage the benefits through the spendit | Portal, while employees enjoy a simple experience via the myBenefits app.

With Solaris, Spendit offers prepaid cards, settlement transfer accounts, and seamless onboarding through KYB services—creating an end-to-end solution that enhances the user experience and supports scalable growth.

Challenge

When Spendit’s former banking-as-a-service (BaaS) provider unexpectedly ceased operations, the company had to urgently migrate its entire financial portfolio to a reliable banking infrastructure:

- Spendit required a smooth and fast migration process to transition all existing customer cards and accounts, and operations. The migration needed to happen with limited impact to business activities, ensuring minimal downtime for users during the changeover.

- Maintaining a high-quality user experience was key. Spendit needed an all-in-one digital banking provider that could guarantee the delivery of their financial portfolio, so users could continue to access their benefit without interruption.

- Spendit required a trustworthy provider with robust compliance and insolvency protection measures, as well as long-term scalability. The goal was to find a partner who could adapt to Spendit’s evolving needs as they expand their offerings.

Our solution

How the SpenditCard embeds financial features

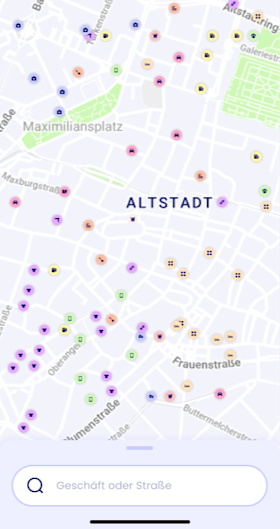

The SpenditCard is a benefit in kind card designed to help businesses motivate and retain employees while offering tax advantages that deliver greater net value. As an open-loop VISA card, it can be used in an employee’s respective chosen region anywhere VISA is accepted, providing employees with flexibility. Through the myBenefits app, employees can easily check their up-to-date balance and manage their spending. The portal and app are practical tools for companies and employees to clearly track the use of benefits.

The administrative burden for employers is low. Administration in the spendit | Portal further optimizes HR processes by simplifying payroll accounting and centralizing benefit management.

Business and freelancer onboarding made easy

Spendit’s Know Your Customer (KYC) process ensures smooth and compliant onboarding for new businesses and freelancers. Fully aligned with Anti-Money Laundering (AML) standards and local regulations, Spendit simplifies online identity verification while minimizing risk.

This efficient and secure identification platform helps businesses reduce fraud risks and ensures that all customer identities are verified in line with legal obligations. With Solaris, Spendit simplifies compliance and onboards clients confidently within regulatory boundaries.

The project in numbers

- 7months of migration

- 100.000+cards active

- 7.000+customers impacted

What they say about us

“Through our partnership with Solaris, we combine state-of-the-art embedded finance technology with innovative product solutions in the SpenditCard. This allows us to create a seamless and forward-looking customer experience that sets new standards in terms of user-friendliness, reliability and personalization for our customers.”

CPTO, Spendit